Measure Performance

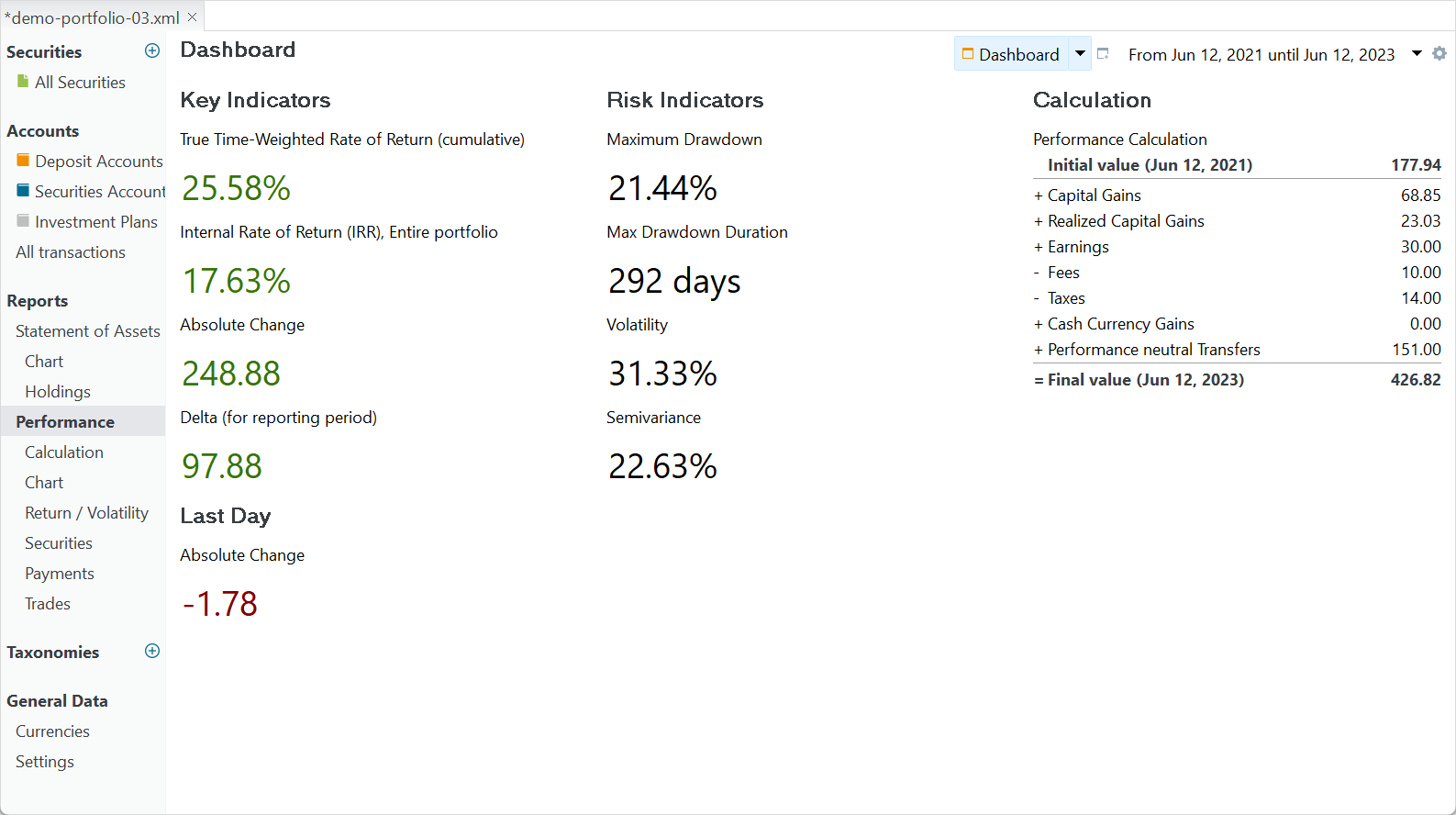

To assess your portfolio's performance, start by examining the Dashboard. Key performance and risk indicators for the entire portfolio are summarized in a dashboard, accessible through the menu View > Reports > Performance or via the sidebar (see Figure 1). A comprehensive review of the dashboard is available in the Reference Manual under View > Performance. As always, green values indicate a profit, while red signifies a loss.

To follow along with the text and Figure 1, download the demo-portfolio-03 file. Select the 2-year reporting period (top right) from 2021-06-12 → 2023-06-12. This implies that your portfolio already contained some stock by June 12, 2021. We begin by examining the Calculation Widget (on the right side).

- Initial value This is the market value of the portfolio at the beginning of the reporting period (MVB), e.g. 177.94 EUR. On that day, your portfolio held 10

share-1shares valued at 17.79 EUR per share, totaling 177.94 EUR (look here for an overview of all transactions in the demo portfolio). Please note, that the historical price of the stock on that day is taken, not the original buying price. - Final value This is the market value of the portfolio at the end of the reporting period; e.g. 426.82 EUR. To verify the final value, navigate to

sidebar > Reports > Performance > Calculationand click on theAssets at Endheading tab. The deposit account shows 125 EUR from deposit, buy, dividend, and sell transactions.share-1is valued at 190.06 EUR (10 remaining shares x 19.06), andshare-2at 111.76 (8 shares x 13.97). In total, this sums to 426.62 EUR, representing theFinal (market) valueof your portfolio on June 12, 2023. - Performance neutral Transfers These are the deposits or withdrawals (removals) that do not affect the performance of the portfolio. For example, the deposit of 84 EUR (additional

share-1), and 67 EUR (share-2) are neutralized by buying both securities. Note that the original deposit and purchase ofshare-1(155 EUR) is not included because it fell outside the reporting period. - Capital Gains represent the increase (or decrease) of the value of your stock between begin and end of the reporting period. Determining the buying value of

share-1is somewhat complex due to the additional buy and sale. Portfolio Performance follows the FIFO (First-In-First-out) principle. From the remaining 10 shares, 5 will come from the first purchase and 5 from the second purchase. The historical quote at the first purchase date was 17.794 EUR/share and at the second purchase data 15.962 given an average price of (17.794 + 15.962)/2 = 16.878 EUR. The final market value is 19.006 EUR given a capital gain of 10 x (19.006-16.878) = 21.28 EUR. The value ofshare-2has increased from 8 EUR (on 2022-09-30) to 13.97 (on 2023-06-12) or a capital gain of 8 x 5.97 = 47.76 EUR. Added together, this gives a total Capital Gain of 69.04 EUR. - Realized Capital Gains result from selling stock. On

2023-04-12, you sold 5share-1shares at 22.40 EUR per share. Given the FIFO principle, the buying price was 17.794 EUR per share, producing a Realized Capital Gain of 5 x (22.40 - 17.794) = 23.03 EUR. - Earnings are caused by dividend payments (15 x 2 = 30 EUR), while Fees and Taxes encompass all fees and taxes incurred in the reporting period. Keep in mind that fees and taxes were also paid for the purchase of

share-1, outside the reporting period.

The first column of the dashboard lists the performance key indicators. We start with the more easily comprehended Absolute change and Delta.

- Absolute Change The difference between the final and initial value; e.g. 426.82 - 177.94 = 248.88 EUR. In this case, you earned a profit: your portfolio is more worth than it was in the beginning. Note that this profit includes the investments or external cash inflows you made to buy additional shares.

- Delta (for the reporting period) is equal to the

Absolute Changeminus thePerformance neutral Transfers, resulting in 97.88 EUR. You might be tempted to think that Delta should be equal to the sum of all sub calculations (Capital Gains + Realize Capital Gains + ...). As you may noted however, the numbers in the calculation panel do not add up; e.g. Final value <> Initial value + ... Otherwise, you would have counted some elements twice. For example, the result of the dividend and sale is put on a deposit account and as such already included in both the Realized Capital Gains and Earnings and also in Performance Neutral Transfers. - Internal Rate of Return (IRR) stands at 17.63%. This is the annual interest rate required to bring the initial market value of 177.94 EUR and all subsequent cash flows of 151 EUR to the final market value of 426.82 EUR. Therefore, the IRR is a percentage illustrating how well your portfolio performs, considering when and how much money you've invested or withdrawn (more info here).

- Cumulative True Time-Weighted Rate of Return (TTWOR) is 25.58%. It represents the growth rate of your portfolio from 177.94 EUR to 426.82 EUR, excluding external cash flows. TTWOR measures the growth of your investments without being influenced by the timing and size of your contributions or withdrawals (more info here).

- Last Day is the absolute change in the market value of the portfolio between today and the previous trading day before 'today'. As such, the value from Figure 1 will probably be different from the value you see in your demo-portfolio-03 file.