Importing documents

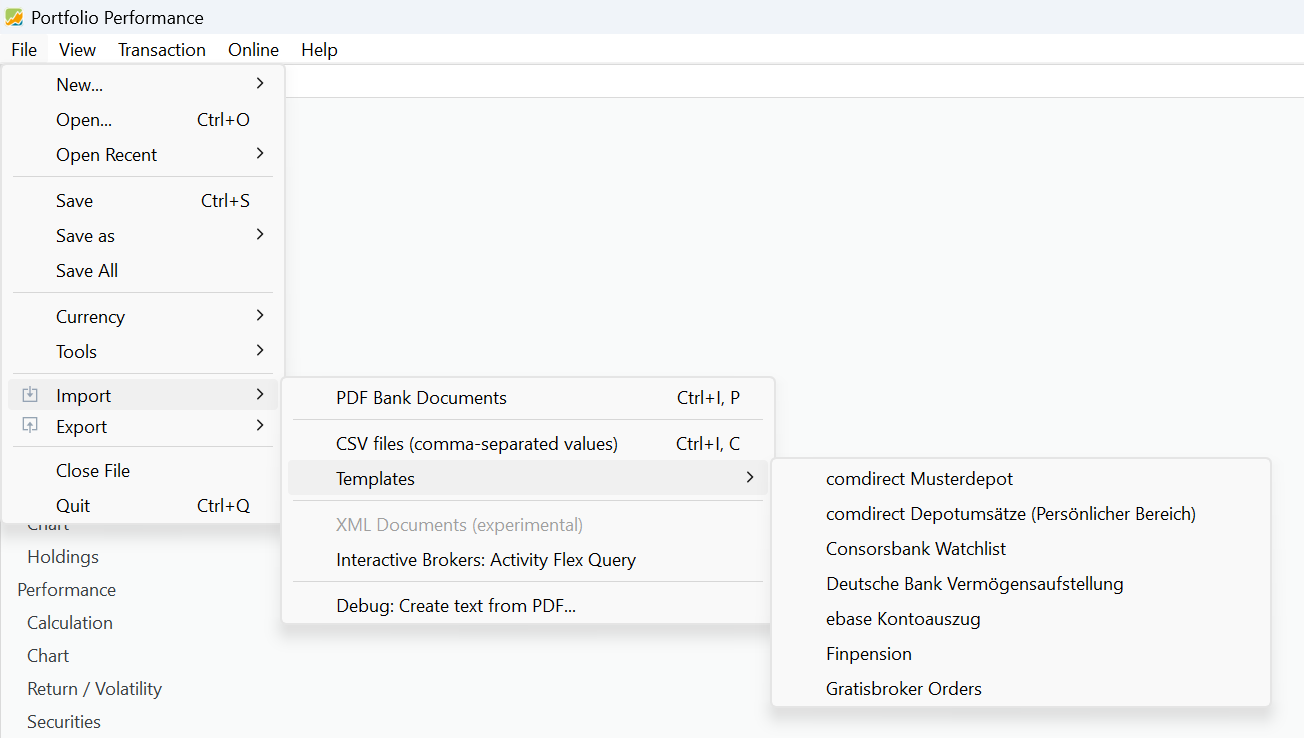

In Portfolio Performance you can enter your data (buy, sell, dividends, historical quotes, … ) manually but you can also import this info from a CSV file (comma-separated values) or from a PDF document. Figure 1 displays the expanded File > Import menu.

There are two primary data sources: PDF documents and CSV files (comma-separated values). Some brokers or banks may present this information in a proprietary format. Templates for major banks or brokers are available.